By Sally Forman, Controller, Bond Collective

If you’re part of a startup, you’ve probably heard the words “cap table” one or two times. That’s because the cap table is an essential part of a company’s structure and valuation. In fact, creating a cap table is — or should be — one of the first steps in forming a startup.

But what exactly is a cap table, and why is it so important? The experts at Bond Collective answer those questions and more in this article.

What Is A Cap Table?

A capitalization table (or “cap table” for short) is a table illustrating the capitalization of a company. More specifically, a cap table is a listing of all the shareholders and their corresponding assigned stock. A company then uses the cap table to track the total amount of shares, the value of those shares, and the equity ownership of all the startup’s shareholders.

Cap tables are usually kept in a ledger or a spreadsheet. So, in the most basic form, a cap table is simply a column of names (the shareholders) with a column of numbers (shares) next to it. It might look something like this:

From this, you learn that Jim holds 1,000,000 shares, Kate holds 500,000 shares, and so on. And assuming this is the complete list, you also learn that the total number of shares amounts to 2,500,000.

Keep in mind that the names and numbers above are an extremely simplified version of what a cap table will look like. Completed cap tables can be very complicated. Exactly how complicated depends on how you structure the stock in your startup.

Why Is A Cap Table Important?

The cap table you produce for your startup is important because it illustrates who has control — ownership — of the company. So in the table below, Jim has twice as much “leverage” as Ed.

Viewed from a different angle, if one vote equals 1,000,000 shares (let’s say it’s a “Yes”), both Kate and Ed would have to be in agreement (with a “No”) to counteract Jim’s vote. This can have a dramatic impact on the decision-making process of the startup and the ultimate direction it takes.

Another important aspect of the cap table is that it represents money — a potentially significant amount of money. Investment in a startup can range anywhere from the low five figures to the high seven figures (or even more). Then as the startup grows and becomes profitable, that stock can double or triple in value. Even a small error on a cap table can mean a difference of hundreds-of-thousands, if not millions, of dollars.

In the beginning, however, ownership and dollar value may not be as critical because the startup has yet to accomplish anything. Even so, the cap table is still important because:

-

Potential investors can use the information to evaluate how much control and leverage they will get for their money.

-

Current investors can see who has control and can use the data to forecast their position (and potential profit) in the company.

-

Stockholders can see the value of their shares in real time.

-

The data provides historical insight that can affect your startup’s valuation when it comes time for a new round of fundraising.

-

It allows you to accurately present your company’s history and holdings in the event of an audit.

-

Founders can use the information to quickly determine what percentage of the startup they have to offer a new investor.

As you can surmise, the importance of a well-set-up and well-maintained cap table increases the longer your business exists. That’s why it’s key to the success of your startup to get it right the first time.

How To Read A Cap Table

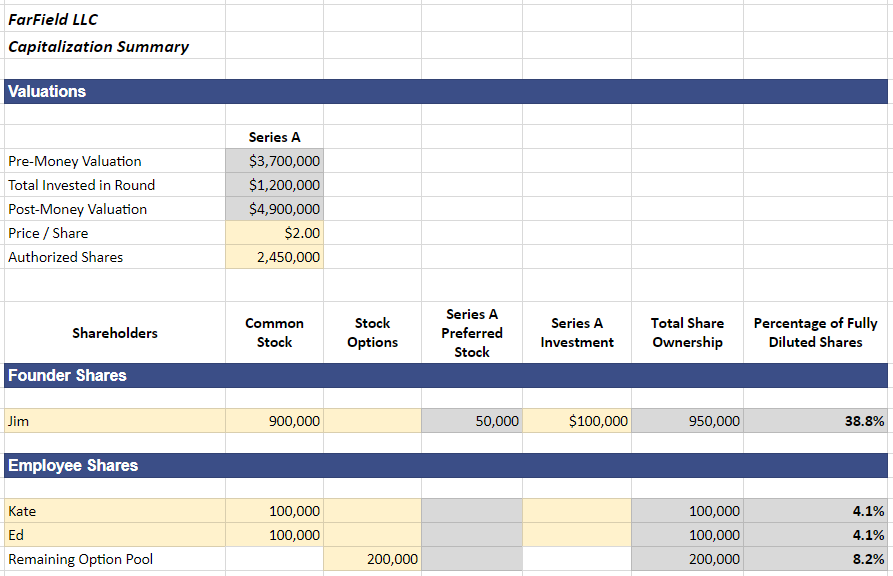

Series A

This term refers to the round in which your startup is raising money. In the future, your startup may need to raise more money. At that time, you would calculate another round of investments (Series B).

Pre-Money Valuation

This is the value of your startup before any investment occurs. Pre-money valuation is usually set by negotiation between company management and investors.

Post-Money Valuation

This is the value of your startup after an investment has been made. It’s calculated by adding the pre-money valuation and the total dollar amount of the investments raised.

Price Per Share

As the name suggests, this is the price for one share of stock in your startup. It’s calculated with the following formula:

Pre-Money Valuation / (Common Stock + Stock Options) = Price Per Share

In this cap table, the price per share is $2.

Authorized Shares

The authorized shares (or securities) are the total number of shares that have been authorized for issuance by your startup’s owners.

Common Stock

Common stock is the most basic form of ownership in your startup.

Stock Options

A contractual right to purchase a specified number of shares at future date.

Preferred Stock

Preferred stock is a class of stock with special rights as outlined in your startup’s charter. There are different types of preferred stock including:

-

Convertible

-

Participating

-

Non-participating

They all come with a different set of privileges.

Investment

This refers to the dollar amount invested during a particular series (in this case, Series A).

Total Share Ownership

Total share ownership is the sum of the common stock, stock options, preferred stock, and any other category of stock for a single individual.

Percentage Of Fully Diluted Shares

We’ll explain fully diluted shares below, but this column basically shows you how much of the company a specific individual owns. Founders and high-dollar investors typically own a larger percentage of the fully diluted shares.

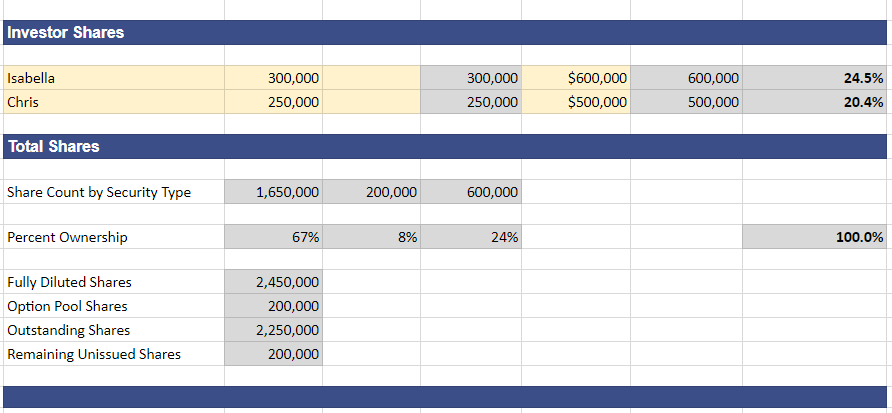

Remaining Option Pool/Option Pool Shares

These shares — often referred to as simply “the pool” — are reserved for later issuance by your startup when stock options are purchased. These are often included in a compensation package for employees working in the startup.

Keep in mind that option pool shares are not outstanding shares (explained below) so no stockholder owns them.

Share Count By Security Type

Security type refers to the various categories of stocks — common, options, preferred — that your startup can issue. This particular section shows you the total amount of each of the security types issued.

Percent Ownership

Percent ownership shows you what chunk of the authorized shares (as a percentage) each person owns.

Fully Diluted Shares

Fully diluted shares refer to the number of shares that would be available if all possible sources of stock were converted. For example, if you had to liquidate your startup (convert everything to cash), the fully diluted shares indicates the value.

Outstanding Shares

This is the total number of shares that have been issued. The outstanding shares category does not include:

-

Stock options that have not been granted (the pool)

-

Granted options that have not be exercised

Remaining Unissued Shares

The remaining unissued shares value tells you the total number of shares you have left to issue. It includes all security types (common, options, preferred, etc.).

Other Terms You May See

Warrants

Warrants are like options. They are a contractual right to purchase a specified number of shares for a specified price at a specified future date. Warrants may use shares set aside in the pool, but they are typically “one-offs” and are not included in the stock option plan. Warrants tend to be issued as a form of currency in business transactions.

Restricted Stock

Restricted stocks (or restricted shares) are granted up front with restrictions that reduce over time. This is in contrast to stock options which are granted at a later date with rights that increase over time.

Restricted stock is being used more and more in place of stock options because of its greater potential tax efficiency.

Invest Time In Setting Up Your Cap Table

As you can see, a well-organized cap table is the lifeblood of your startup and should be treated as such. It’s always a good idea to invest some time in setting up your cap table. That way, all your ownership and monetary bases will be covered before you get into the thick of actually running the business.

For more business advice and to learn about the advantages of coworking spaces for startups, digital nomads, remote workers, and enterprises of all types and sizes, visit BondCollective.com today.